This topic contains 0 replies, has 1 voice, and was last updated by Greg Abbott 10 years, 1 month ago.

-

Prohibit legislators from serving as bond counsel for any public entity

Started by Greg Abbott

Recommendation: Prohibit legislators, including the Lieutenant Governor and Speaker of the House, from serving as bond counsel for any public entity. Violation of this requirement would be a Class A Misdemeanor.

Texas Government Code Chapter 572 (Personal Financial Disclosure, Standard of Conduct, and Conflict of Interest) opens with this statement of legislative intent:

Sec. 572.001. POLICY; LEGISLATIVE INTENT. (a) It is the policy of this state that a state officer or state employee may not have a direct or indirect interest, including financial and other interests, or engage in a business transaction or professional activity, or incur any obligation of any nature that is in substantial conflict with the proper discharge of the officer’s or employee’s duties in the public interest.

Chapter 572 includes limitations on representation by legislators before state agencies, limitations on contracts by state officers with governmental entities, and restrictions on the leases legislators may enter into. An explicit restriction against serving as bond counsel would be a similar and appropriate restriction on the activities of legislators, and in accord with the general spirit of the chapter.

Simply, legislators should not profit from public debt by serving as bond counsel. Texas’ local public debt is high and climbing. As noted in Greg Abbott’s “Working Texans” plan, Texas local debt is among the highest per capita among the larger states:

Texas has extremely high levels of local debt. According to the Texas Bond Review Board (BRB), local governments have $195.81 billion in outstanding bond debt. This translates to $7,787 in local debt per capita – the second highest per capita local debt burden in the nation among the ten largest states, behind only New York, and immediately ahead of California, Pennsylvania, and Illinois. It is also worth noting that local government debt accounts for 83 percent of all public debt in Texas, with state debt accounting for the remaining 17 percent.

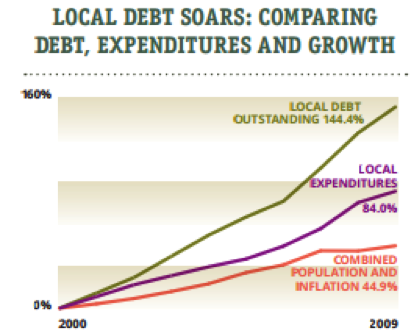

Indeed, according to data from the U.S. Census Bureau and the Bureau of Labor Statistics compiled by the office of the Texas Comptroller of Public Accounts, between 2000 and 2009, the amount of outstanding Texas local government debt grew more quickly than local government spending. As shown in the graph below, the 144.4% growth of local debt in that period has far outstripped both the growth of local expenditures in that period (84.0%) and the rate of increase of population and inflation (44.9%).

Source: Texas Comptroller of Public AccountsWhen legislators, through their private work, become intimately involved in the financial process of local entities, ethically problematic situations develop wherein legislators find themselves with a personal incentive to increase local debt. In particular, the situation arises when legislators who are also attorneys take positions as “bond counsel” for public entities. A bond counsel is a specialized attorney who works with public bonds, and is typically “compensated only if bonds are sold and from bond proceeds.”

Governmental entities issuing bonds generally hire specialized attorneys known as “bond counsel,” whose role includes giving a legal opinion that the issuing entity:

- Is authorized to issue the proposed bonds;

- Has met all legal requirements for issuance; and,

- That interest on the bonds will be excluded from federal and, if applicable, state and local income tax.

State legislators have served as bond counsel in the past. However, legislators have a very close relationship with bond authorization – an area which is governed by the Texas Constitution where applicable, but is usually statutorily authorized by action of the Legislature (among other examples, see: Local Government Code Chapters 331 and 334; Transportation Code 22.052; and Government Code Chapters 1504, 1506,1508, and 1510, and Government Code Section 1331).

When a legislator serves as bond counsel – and thereby derives a direct financial benefit from the issuance of bonds – the legislator has a personal incentive to vote to authorize an increase in the issuance of bonds, and to create political subdivisions with the authority to issue debt. Because of the close relationship of legislators and bond issuance, and the negative impact local debt can have on the state’s fiscal health, Texas should prohibit legislators from serving as bond counsel for any public entity. This may be accomplished by adding a new provision to Texas Government Code Chapter 572 barring any current Texas legislator from offering legal representation to any public entity related to the issuance or proposed issuance of bonds or other similar mechanisms of debt financing.

You will need to login to join the discussion.0Replies